Understanding Liquidity Pools in DeFi

Liquidity pools have become a cornerstone of the Decentralized Finance (DeFi) ecosystem, offering users a way to engage with decentralized exchanges (DEXs) and yield farming protocols. But what exactly are liquidity pools, how do they work, and why are they so important in the world of cryptocurrency? In this post, we will break down liquidity pools in simple terms and explore their role in DeFi.

What is a Liquidity Pool?

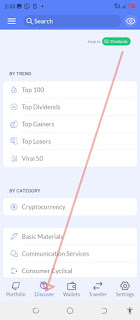

A liquidity pool is a collection of funds locked in a smart contract that provides liquidity for decentralized exchanges (DEXs) or decentralized finance (DeFi) protocols. These pools are made up of assets provided by users who are willing to contribute their tokens in exchange for potential rewards.

Liquidity pools allow users to trade assets without the need for a traditional order book system, which is commonly found in centralized exchanges. Instead of matching buyers and sellers, liquidity pools allow users to trade directly with the pool itself, making transactions faster and more efficient.

How Do Liquidity Pools Work?

At the core of a liquidity pool is the concept of automated market makers (AMMs). AMMs are algorithms used by decentralized exchanges to determine the price of assets within the pool. These algorithms use a mathematical formula, such as the constant product formula (x * y = k), to ensure that the value of the assets in the pool remains balanced.

Here's how it works:

- Users contribute an equal value of two assets to a liquidity pool, such as ETH and DAI.

- When someone wants to make a trade, they can swap one asset for another directly from the pool. The AMM adjusts the price based on the available liquidity.

- Liquidity providers (LPs) earn a portion of the fees generated from trades, proportionate to their contribution to the pool.

The pool’s function is simple: ensure there is always enough liquidity to facilitate trades between different token pairs, which helps reduce price slippage and ensures market efficiency.

Why are Liquidity Pools Important?

Liquidity pools play a vital role in the success and operation of decentralized exchanges and DeFi platforms. Here are some of the key benefits:

- Decentralization: Liquidity pools enable the decentralization of trading and financial services, as there’s no need for a central authority to match buyers and sellers.

- Lower Fees: With liquidity pools, traders often face lower fees compared to traditional exchanges because they eliminate intermediaries.

- Price Stability: Liquidity pools help maintain stable prices for tokens by allowing assets to be swapped in a way that balances supply and demand.

- Yield Farming: By contributing to liquidity pools, users can earn rewards, typically in the form of additional tokens or a share of transaction fees, through a process called yield farming.

How to Participate in a Liquidity Pool?

Participating in a liquidity pool is a relatively simple process,